2024 may be the breakout year to buy a used EV:

- Hertz just announced they’re putting 20,000 Teslas (and other EVs) up for sale, including Tesla Model 3s from $14,000.

- On January 1st, the IRS officially launched a program to allow dealers to give buyers the $4,000 Used EV Tax Credit upfront, which can act like an additional down payment at point of sale.

There are just two problems:

- A very small percentage of used car dealers are registered to transfer the $4,000 credit. (Used EVs represent only 10% of EV Tax Credits filed this year.)

- The used EV credit has complex qualification rules for the vehicle and your income. There’s also thousands of dollars in state or local rebates available, but they’re time consuming to find and qualify for.

KeySavvy and EV Life have teamed up to help used EV buyers to solve all these problems and maximize their savings.

How does it work?

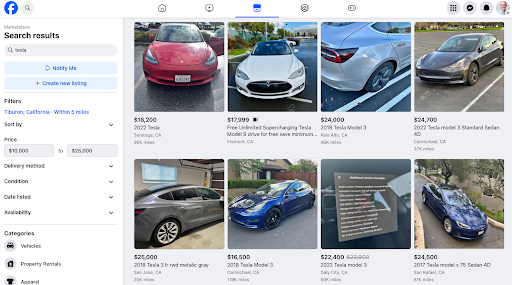

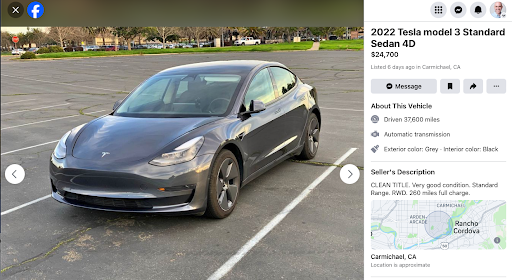

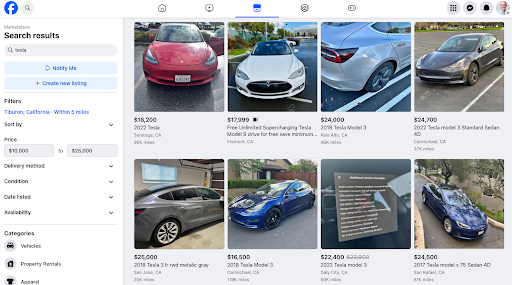

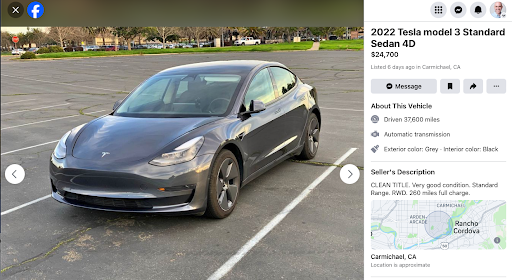

Step 1: Find a used EV under $25,000 being sold by a private seller

Popular sites for finding a used EV for sale include Facebook Marketplace, OfferUp, and Craigslist.

For example, several Tesla Model 3s are listed for under $25,000 on Facebook Marketplace.

But there are many places where you can find used EVs at great prices. In order to qualify for the $4,000 credit, the car must be under $25k, and it must be sold through an IRS-registered dealer, like KeySavvy.

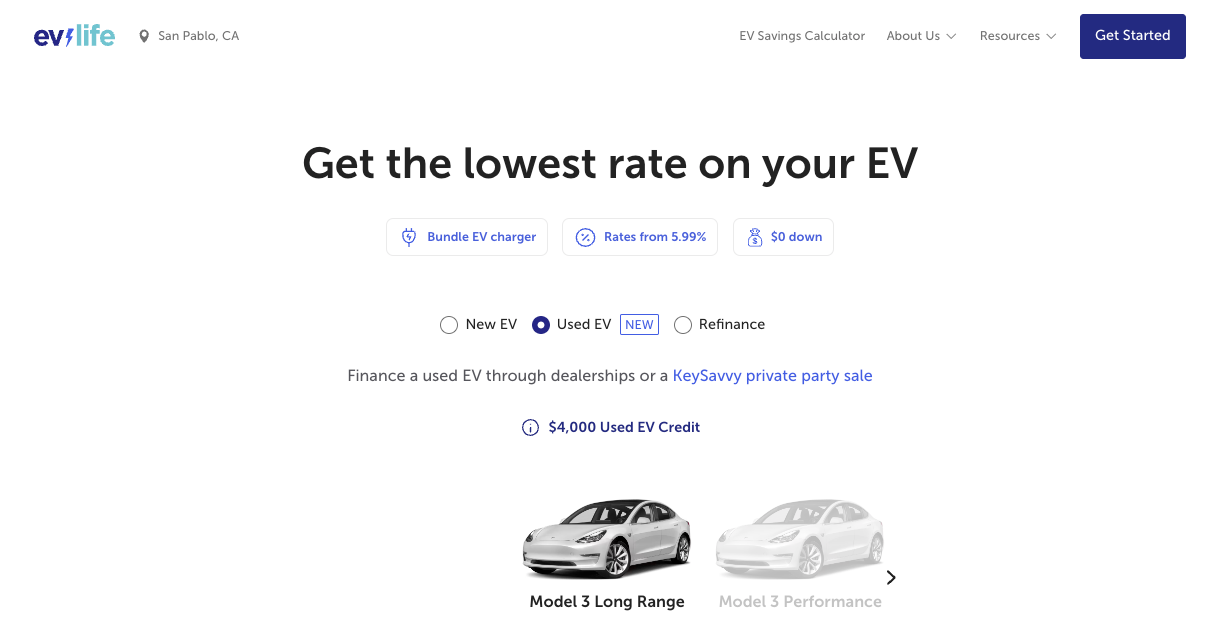

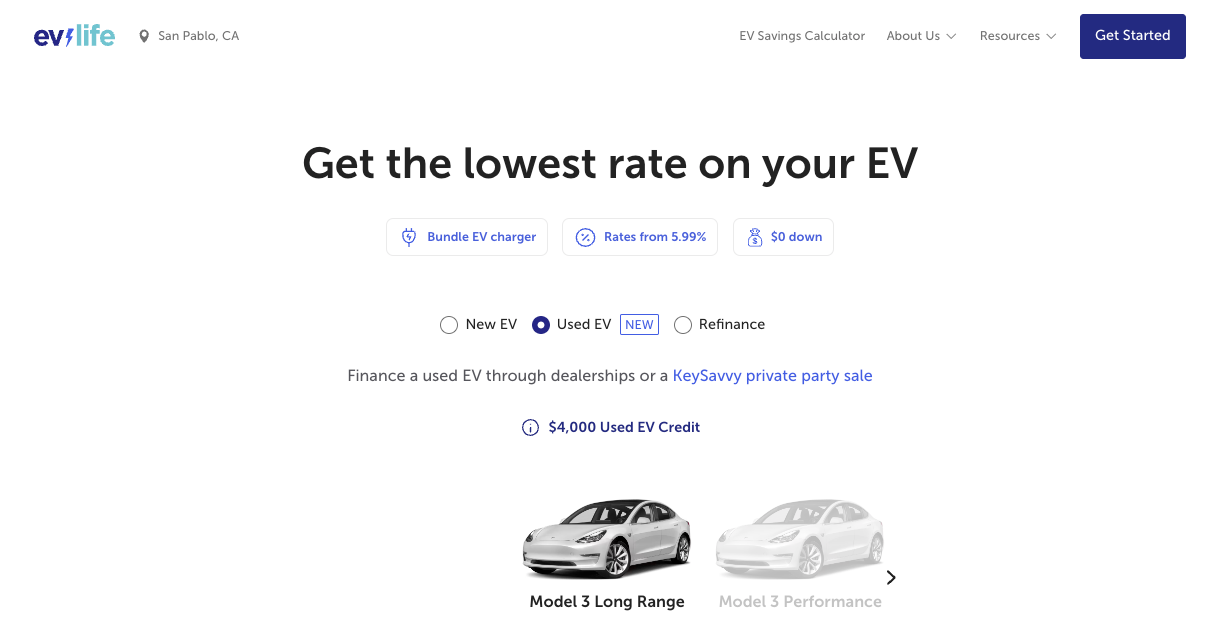

Step 2: Prequalify for EV Life Financing with Tax Credits & Rebates

When you prequalify for used EV financing, EV Life checks if you and your vehicle qualify for the Used EV Tax Credit. We also scan our Incentives Engine of 500+ incentives to see if you qualify for thousands of dollars in hard to find local rebates. Plus, we guarantee the lowest rate on EV financing anywhere.

To get started, Check Your Rate in 2 minutes.

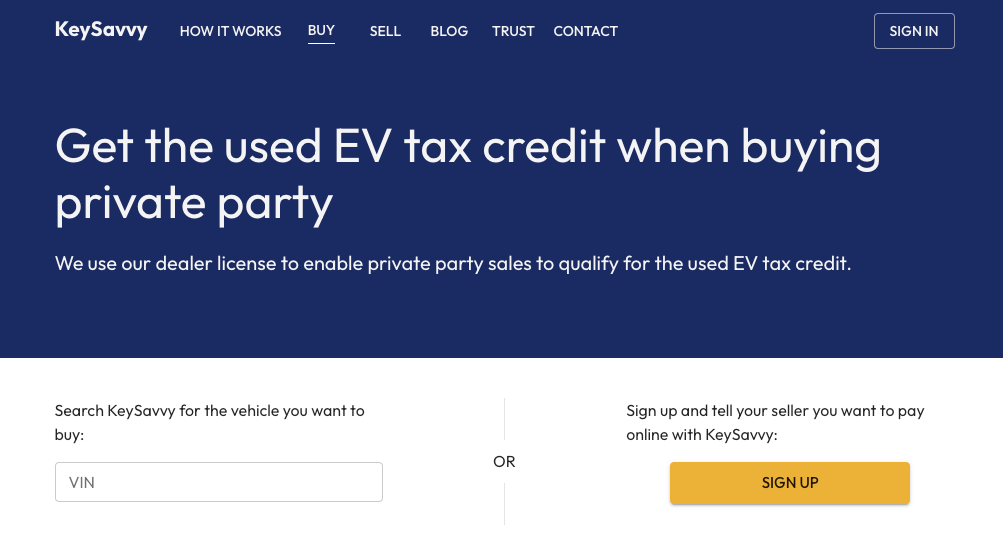

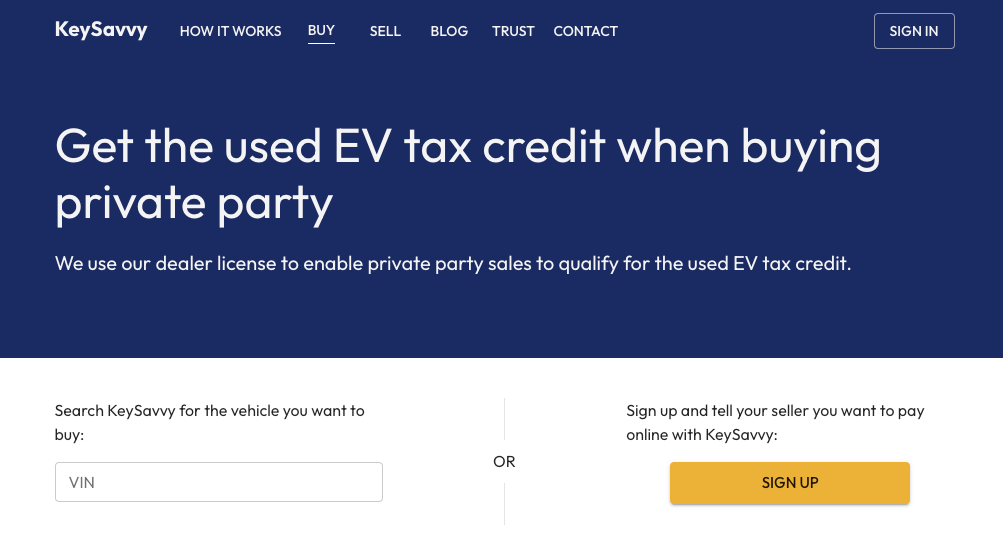

Step 3: Sign up to buy your EV using KeySavvy

Once you’re qualified for a loan from EV Life, you’ll need to navigate to KeySavvy, a licensed online auto dealer that eliminates title fraud by verifying your seller's ownership and makes it easy to pay your seller online.

Most importantly, KeySavvy is IRS-registered to pass through the $4,000 Used EV Tax Credit on your private party EV purchase. They'll check to make sure the vehicle meets the requirements for the tax credit, including the confusing "first transfer rule" set by the IRS.

To get started, signup here and tell your seller you want to pay online with KeySavvy so you can get your $4,000 EV tax credit.

Buyers and sellers each pay a fee of $79. If the vehicle you’re buying still has an outstanding loan, KeySavvy will charge an additional $99 to pay off the loan as part of the sale.

When you sign up with KeySavvy, be sure to note you’re financing with EV Life.

Step 4: Finance Your Used EV in as Little as 24 Hours

If you finance with a bank or credit union, it can sometimes take a week to finalize a purchase with cashier’s checks or money transfers.

As mission-driven technology startups, KeySavvy and EV Life have integrated our electronic payment systems to make buying your EV fast and easy.

Once you’re approved for an EV Life loan and signed up for KeySavvy, you can close your used EV purchase through KeySavvy in as little as 24 hours from loan approval. Depending on how much of the tax credit you qualify for, the IRS will knock up to $4,000 off your checkout price through KeySavvy.